It wasn’t long ago there was talk of the Goldilocks Economy – not too hot, not too cold.

It was juuuuust right.

Unemployment around 4%.

Inflation around 2%.

Wages growth around 2%.

But as in the story – the Three Bears came home…

Just who are these Three Bears at the moment?

The first bear was called Covid – and to stave off the effects of this bear – central banks made money cheap, and governments splashed the cash with a fire hose in every direction.

To be fair – this did stave off economic disaster.

BUT… during Covid people could not spend it in any meaningful way – and now they can. This is fueling inflation.

The second bear was called Russia – this bear saw an opportunity immediately post Covid, and by threatening the supply of gas to Europe figured it could bluff its way into taking Ukraine. Restricted gas supplies from a continent dependent on Russia forced up the price of ALL fossil fuels. This flows through into the price of EVERYTHING – fueling inflation.

And – you guessed it – the third bear is called Inflation. While there is little that Goldilocks can do to stave off this bear – its effects are severe. The US Reserve is raising interest rates to stifle demand – and given the US Dollar determines all other currencies, if other countries do not follow on rates, then their currency deteriorates. In very basic terms – petrol in Australia wouldn’t be $2… it would be $4. The inflation bear damages everyone.

The Covid cash will soon be spent, and that bear will go back into its cave.

The Russian bear has likely miscalculated very badly – becoming ever more desperate.

The Inflation bear is more predictable (depending mostly on bear number 2).

And so, what should Goldilocks do? Watch the US Federal Reserve very carefully is the answer.

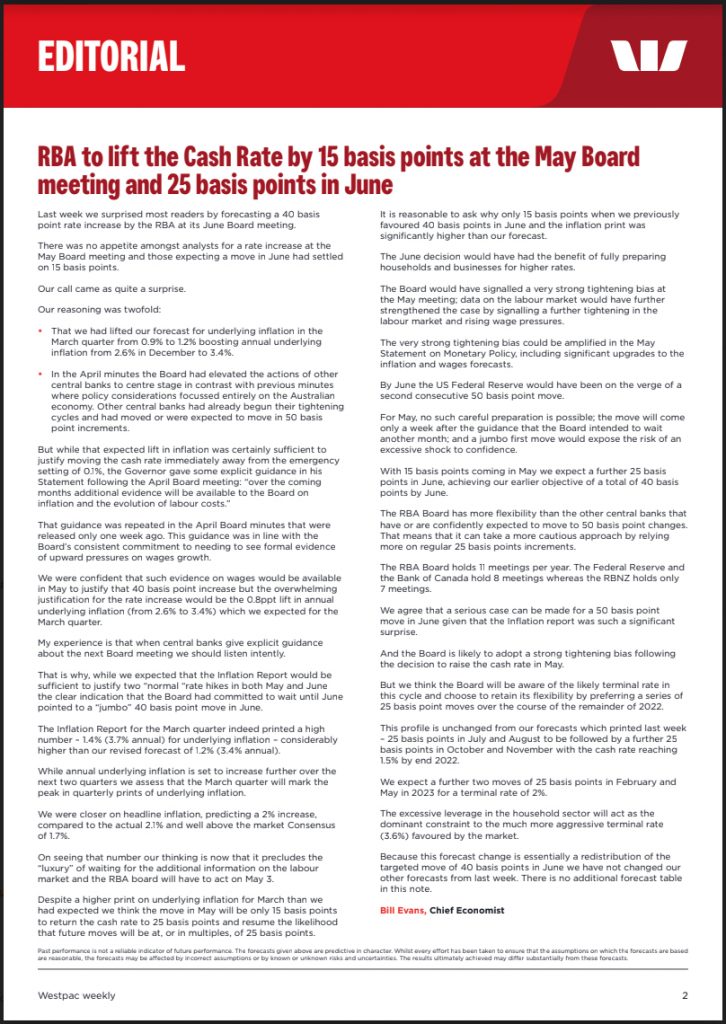

As you know – I watch Bill Evans very closely (If you would like to read his full and detailed comments follow this link)

The Bill Evans update is that the US Reserve will stop at (their equivalent of) 4.6% and that (most importantly for us) the Australian Reserve will stop at 3.6% (up from 3.35%).

The reasoning being that as a net exporter of fossil fuels (gas and coal) we are better protected from the Russian bear than most.

This means we now predict a peak of 5.5% for home loan interest rates here. I have adjusted my loan calculator for you to work that out for you. Calculator

Email me if you would like me to work that payment out for you.

I still do not believe that fixing a rate tames the bears – because you will be fixing above the predicted peak – with no opportunity to reduce that rate when the bears become more like Paddington than a Grizzly.

Eventually the cuddly bears will return.

Remember, one ending of the Goldilocks story was that they all became friends and had tea parties together.

As always if you’d like advice tailored to your own personal circumstances please call or email me anytime… It’s what I’m here for.

Ask Alan, Australia’s Trusted Mortgage Broker