Anyone can read in the media that The Reserve Bank cut the cash rate yesterday.

I always endeavour to let you know what this means – so that you can plan ahead.

In July 2016 – almost 10 years after the GFC, interest rates had been low for a decade, there was a growing sentiment that they would inevitably rise – which always makes people worry.

I like to take notice of the people who have the RED (rates) button on their desk so back in 2016 I read an article from Janet Yelland (the outgoing chair of the US Federal Reserve) who had just told Congress that rates would stay low for ANOTHER decade – yes until 2025.

I wrote to you of that in July 2016.

Even more telling in that article (looking back) there was a prediction of likely rate cuts in 2019 – how accurate did that turn out to be!! https://bit.ly/2Wo5Lh4

Central banks respond to inflation, unemployment and economic growth “in the present” – that is their charter. This is also why the Reserve Bank governor asked banks to pass on (as much as they could) of this rate cut. By and large this is happening.

The Reserve Bank governor could not have been clearer – there are further rate cuts to come.

The world economy is hitting a flat spot for easily defined reasons (US China trade tensions, and Euro paralysis over Brexit and the very existence and relevance of the EU) This will take a little while to work itself out.

How do countries respond?

I don’t offer judgement – that’s not my role – I simply read tea leaves very carefully and in the midst of your busy lives try to give you a reliable guide for the future.

In a flat spot Australia ALWAYS turns to housing to stimulate its way out. That is because of its flow on to employment, state government income – stamp duty, and retail.

This is precisely WHY the Reserve Bank is cutting rates and precisely WHY they are encouraging banks to pass it through.

The Commonwealth Govt is about to legislate the tax cuts that formed part of the election. In conjunction with the Reserve Bank both are “on the same page”.

It’s always bemusing that when things are supposedly “uncertain” that governments do their best to make things economically “easier”.

This alone is the very reason why in times of uncertainty it is important to leave your interest rate variable. “Fixing” – sold by banks to lock you in, also locks you out of benefitting in such times.

There is never a good time to fix your rate – no matter how tempted you may be from time to time.

So what does this mean for the future of housing?

With election uncertainty now out of the way (and make no mistake – even though housing cycles take roughly 10 years and are almost impervious to what governments do, electoral cycles of 3 years can certainly prolong or shorten housing cycles), we can look back to longer trends in housing with much more confidence.

Let’s return to two graphs I show you from time to time – I keep this data fastidiously.

Sydney and Brisbane median house price in absolute terms;

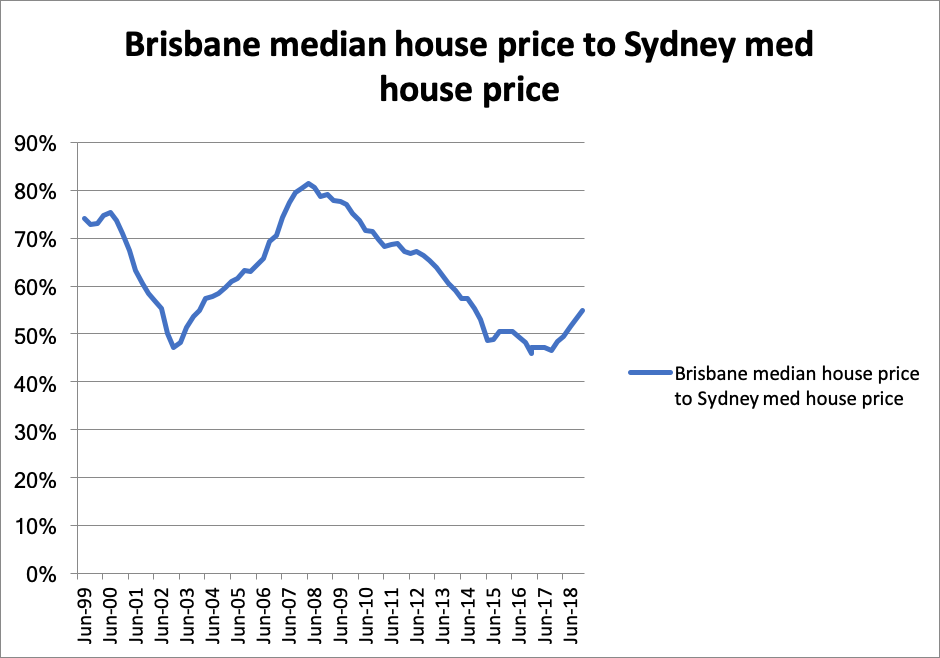

Sydney vs Brisbane median house price as a ratio;

You can replace Sydney with Melbourne. You can replace Brisbane with Adelaide. (Darwin and Perth have much more volatile cycles, Hobart and Canberra also have unique characteristics – Canberra is more like Sydney, Hobart falls in and out of favour from time to time because of its unique lifestyle.)

So although I will talk Sydney and Brisbane – the comments are more general.

Firstly, whenever there is talk of House Price going up and House Price falling in the national media – it is always about Sydney (and Melbourne).

House price is NOT falling in Brisbane (and Adelaide) – I have many frustrated clients trying to buy in these locations because they are finding that out – making low offers that don’t get accepted.

The comment now is that the rate of fall in House Price is slowing – that is true in Sydney (and Melbourne) and hardly surprising – look at graph 1 and compare the period 2002-2005 with 2016-2019.

Those markets overshot (they always do) and then plateau back (they always do).

Now look at Brisbane 2005-2008 and notice that this is Brisbane’s version of “overshooting”.

When Brisbane house price is 50% of Sydney – it is too cheap – and people shift here.

When Brisbane hits 80% of Sydney – in relative terms the “Brisbane” party is over.

Brisbane house parties aren’t quite as exciting as Sydney’s but they still happen as a slow burn.

Now look at graph 2 – the signs from the past could not be clearer.

If you are buying in Brisbane (or Adelaide) you are buying into an upswing.

If you are buying in Sydney (or Melbourne or Canberra) then you are positioning yourself for the NEXT upswing.

It doesn’t matter what you do – you are buying in a period of continued and extended interest rate stability.

This is why I don’t tell you about every time the Reserve bank meets – because the story has a much longer and predictable view.

Yes – with a different election outcome – we might well have had 3 years ahead with the accelerator being hit by the Reserve Bank and the brake being hit by the promised tax increases by the alternative government.

But the election is history and it turns out that the next three years are now more predictable – both government and the Reserve have tapped the accelerator.

So what should YOU do:

- If you are a First Home Buyer – save as hard as you can, and talk to me now so we can plan together for the significant new scheme that will be introduced on Jan 1 – removing the need to pay Mortgage Insurance upfront.

- If you own your own home – then you and I have our own part to play. Leave your rate variable, every 6 months I will review it and obtain an adjustment (down) if that is possible. Your part is to pay your loan “as if the interest rate is 6%”. You can “fix” your payments to give certainty to your budget and build up a buffer for the future. Use my loan calculator to see what this 6% payment is.

- If you are buying a home – then be realistic on price. In Sydney you may be able to bargain, in Brisbane you and the vendor need to find sensible common ground – otherwise you will spend months being in frustration because low offers aren’t accepted.

- If you are investing for the long term and haven’t yet read my series of articles on investing, then why not start there? With taxation uncertainty removed property is (as it has always been) one of the best places to plan for your future.

As always if you would like advice specific to your own personal circumstances, please call or email anytime, it’s what I’m here for.

Just Ask Alan – Your online mortgage broker.