A very predictable path …

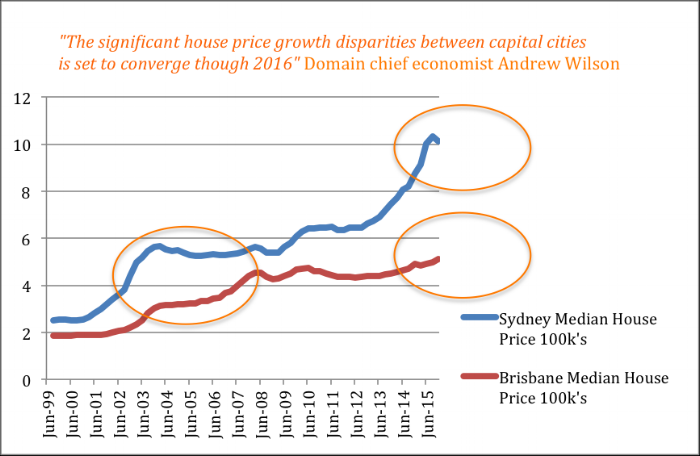

The effects of regulators (APRA and ASIC) in mid 2015 have ensured that price rises seen in Sydney over the last three years have paused. The cycle that has lasted from 2003 to 2015 is now complete.

Other capital cities have had their own cycles, with a degree of loose connection to Sydney. They also have their own contributing local factors.

Sydney investors and owner-occupiers are now turning to the Brisbane market and based on trends visible in the last cycle, Brisbane house price will likely continue to rise for the next few years. This is why Sydney and Brisbane are so closely linked.

Read the Domain.com.au House Price Report, Dec Quarter 2015, in full; click here

If the Brisbane market peaks at 75-80% of Sydney Median House Price as it did in the last cycle, then that would suggest that Brisbane price will move up from its current $511k to around $750k.

Affordability is now a significant handbrake in the Sydney market. Affordability is not yet a factor in the Brisbane (Gold Coast/Sunshine Coast) market where house prices are still on the way up, with low interest rates and (even if temporary) low petrol prices combining to give the markets significant buoyancy.

Funnily enough – it is a reasonable time to invest back in Sydney too – as long as you are buying for the next cycle.

Adelaide is also tracking the Brisbane path. The local factor in Adelaide being around what will create demand – with perceived optimism or pessimism (depending on your view) for which industry will replace car manufacturing.

Historically, when real estate cycles conclude, there is no evidence of substantial price falls – price simply pauses until the next cycle. What this means for you is that “wait and see” in SE Qld or Adelaide will simply mean you will pay more.

As always you can call, text or email me anytime… It’s what I’m here for… 0411 601 459

Alan Heath, Mortgage Choice Brisbane CBD

Brisbane’s trusted mortgage broker of choice…