Last year when Covid hit there were predictions of gloom and doom for property – and they were well founded to an extent… BUT… Two things altered the course of events.

- The Government intervened with Jobkeeper to cushion the blow of Covid Lockdowns.

- The Reserve Bank intervened by dramatically cutting Interest Rates and stating that they will stay low until at least 2023.

I have heard so many predictions of property falling into the abyss over the years.

Just to name a few:

House price collapse: 25 Jan 2014

Housing crash we have to have: 23 Jul 2015

Looming Property Crash: 16 Jun 2017

Property to fall by half: 21 Feb 2019

Worst property downturn in 35 years coming: 13 Mar 2019

Nothing can stop it – housing crash of a lifetime: 17 May 2020

Impending housing catastrophe: 27 Jun 2020

NOT ONE of these headline predictions has ever come true…

The lesson for you for the start of 2021?

I have many clients experiencing the current market as such:

- Those actually buying are finding they have to increase their offers quickly because of multiple bids.

- Those telling me they are waiting to buy after the crash have discovered that “believing the headlines” has cost them literally tens of thousands of dollars, with property prices on the rise.

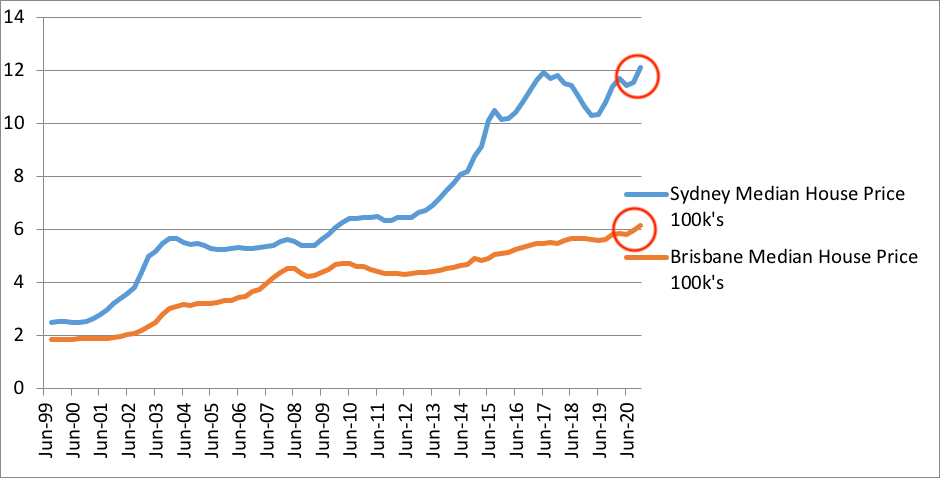

Let’s have a look at house price over the last 20 years – during which time there have been THREE stock market crashes – 2001, 2008 and 2020.

What is the reality for property price?

The major impact on property price is interest rate – not a commentator’s prejudice and opinions.

When the pandemic hit in March last year – there were concerns over property price but the government supported incomes with Jobkeeper and the Reserve Bank supported the economy and the property market by lowering interest rates.

Contrary to commentator opinion, property price is on the rise in EVERY capital city and will continue throughout 2021 – notice the uptick on the graphs above.

There is growing evidence of property price rises in regional cities too, with the pandemic causing a shift out of city centres and seeing the move to working from home a permanent one for many companies.

Demand is vastly outstripping supply both for home owners and tenants. Ask any of my clients who continually missed out on purchases last year due to multiple competing offers…

This now bringing investors back to the property market as well.

If you are thinking of entering the property market for either your own home or an investment property let me help you by:

Calculating your borrowing power

Finding the loan best suited to your needs

Structuring your borrowings to suit you not your bank.

Suggesting you don’t delay – delay will cost you money you could spend on something else.

As always if you would like advice specific to your own personal circumstances, please call or email anytime, it’s what I’m here for.

Ask Alan